Looking for a new apartment in Chicago? If you want to land the best deal, you need to understand the market trends. Afterall, if you go into rent negotiations blind, you’re bound to get a bad deal on your rent.

To help make finding cheaper rent in Chicago easier, here are some key statistics about the rental market trends this year. These Chicago-specific housing market statistics can help you navigate potential apartments pitfalls, so you can get the best deal.

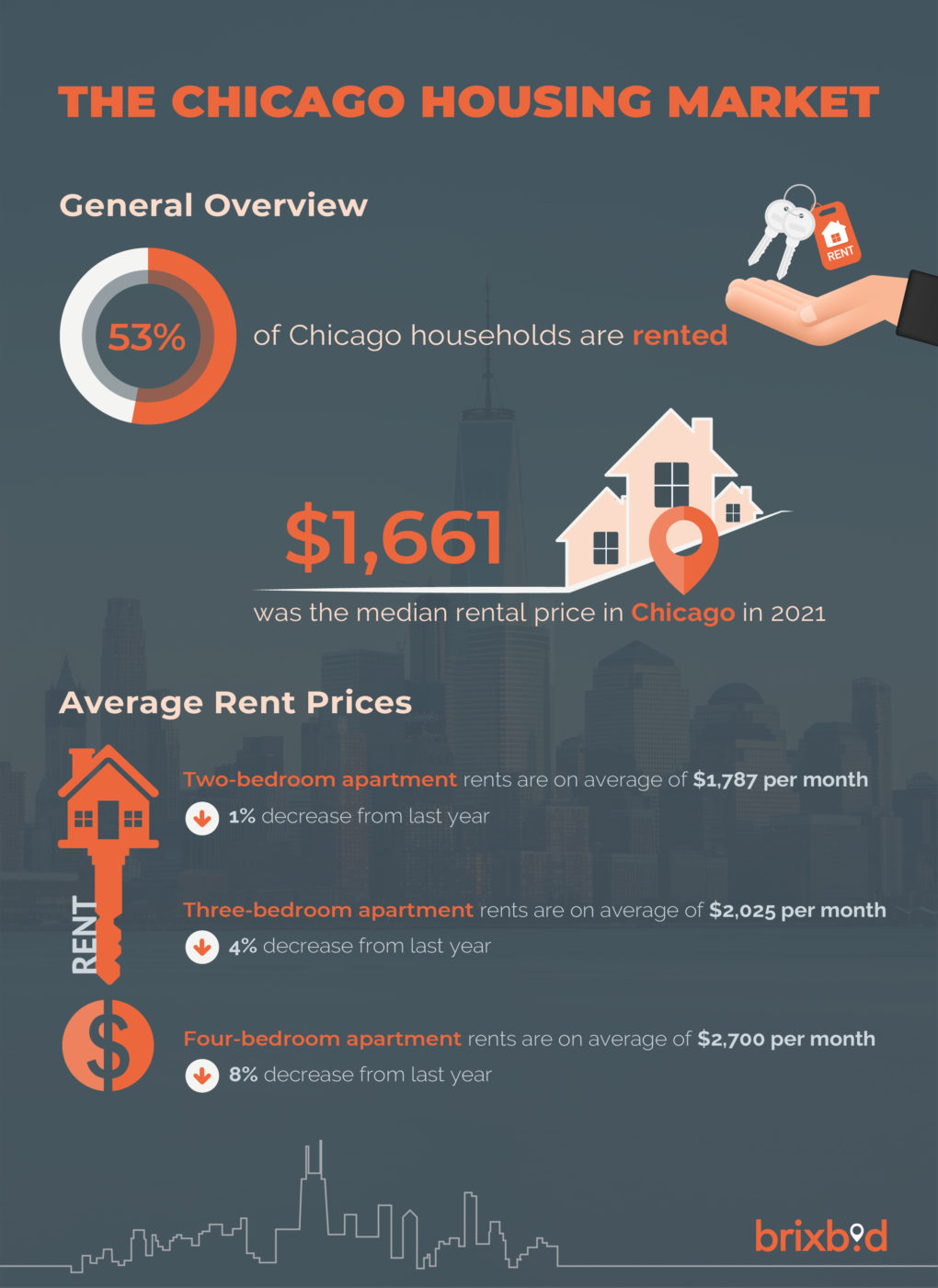

Overview of the Chicago Housing Market

Here is a brief overview of the Chicago Housing Market to help you understand what to expect when you’re shopping for a new apartment. According to Roofstock:

- Chicago is a mid-range city on the national affordability index.

- 53% of Chicago households are rented.

- Most rents have held steady for the past 3 years.

- The average rent for a 3 bedroom house is $2,000 per month, but now is increasing.

- The most expensive areas in which to rent are: Near North Side, the Loop and Near West Side at an average of up to or over $6,000 per month.

- The most affordable areas are New City, Pullman, and Riverdale at an average of $1,200 per month.

According to TheRealDeal there is 120,000 fewer houses on the market. As a result, prices are increasing because there is shrinking availability.

Chicago Rental Prices

This 2021 survey by millionacres found that $1,661 was the median rental price in the Chicago area.

This was slightly less than the national average at the time, which was $1,721. They also claimed that the median rental price had actually dropped over the last year by 2.99%. These findings indicate that an increase in rental vacancies may have been the reason this drop happened.

This claim may seem to clash with the one stated above about the increase in rental prices. However, you need to take into account how long it’s been since this survey came out and when you currently read this post.

House and apartment rental prices may have hit a plateau due to COVID-19. The pandemic has impacted both employment and demographics. Specifically, it has impacted population movement, unemployment due to the pandemic, and uncertainty for the future. Home construction has also slowed due to investor hesitancy.

This is why there is a shortfall in the housing inventory.

Rental Housing Statistics and Trends

Curiosu about rental averages? According to Norada Real Estate Investments, here’s what you can expect:

- Two-bedroom apartment rents are on average of $1,787 per month – 1% decrease from last year

- Three-bedroom apartment rents are on average of $2,025 per month – 4% decrease from last year

- Four-bedroom apartment rents are on average of $2,700 per month – 8% decrease from last year

Despite these housing market statistics, Chicago realtors expect the prices for rental and property sales will rise.

A one-bedroom apartment as of November 2021 had suffered a 2% decrease in rental price compared to the previous year. However, as of January 2022, rentals had increased 4% to $1,500 within just two months.

Chicago Housing Market Statistics 2005-2019

This chart shows the progression of rental rates until 2019 from the last census conducted by the Department of Numbers:

Efficacy of Housing Market Statistics

You may find discrepancies between different sites that quote statistics for the Chicago housing market, but that is usually because of the way data is collected and collated.

If you view a few data sets, you will get a good idea of the current trend. Among the housing market predictions for 2022, real estate professionals in Chicago all broadly agree that prices for buying or renting will go up during the year.

However, nobody can predict how this rise will happen. Whether it will be slow and steady or fast and sharp, only time will tell.

Your Rental Budget

How much you should spend on rent depends on more than just the current standing of the housing market. It also largely depends on your income and earnings. That’s why it’s important to go beyond rental market statistics and evaluate what your rental budget is.

But, how much apartment can you afford to rent? This rent calculator makes it easy for you to figure out.

Generally, you should only use 30% of your monthly income for rental purposes. However, you need to take into account your debt and what kind of lifestyle you live. And that’s why our rental calculator is so helpful.

Unlike other rent calculators that focus solely on the 30% ratio, our rent calculator evaluates your true budget. This way, you don’t experience bill shock AFTER you move into your dream home.

Rent Now for Better Opportunities

With the predicted rise of the Chicago housing market, the time to look for a new apartment to rent is now. The more you wait, the more your rent may be.

If you’re looking to rent an apartment, start by browsing Brixbid’s apartment listings!

You won’t just find awesome apartments to rent. Brixbid’s platform also has built-in rent negotiations. So, you know you get the best price for your dream apartment.